There is a full-page devoted to security measures on the Mint website. User data safety of user data was one of the biggest concerns but they were successful to do that after a long tussle, and rest assured all their users of its advantages. After compiling the mixed feedback he created Mint that addresses each individual’s needs. He took the philosophy that it is better to first validate your idea instead of creating a product and then request feedback. But before creating this app, he asked everyone if they would like to use this form of service or not.

#Intuit mint credit score review free

When Aaron Patzer created a free money management app the inspiration was small he needed to handle his budget for his one start-up which he could not because there was no service of this kind. Mint founder, Aaron Patzer, says “The idea behind is to make it dead simple to get your finances in order and to feel in control of your life”Įvery big brand starts with a small idea. Mint’s name comes from Money INTelligence. Four years later, in 2013, Mint had over 10 million users and slowing adding up the numbers and now has over 15 Million+ users worldwide. Mint was officially founded in September 2007 and in November 2009 it was bought by Intuit, the maker of TurboTax and Quickbooks. That gives an excellent start to this finance start-up and helped establish its credibility and incredible success. Mint gets off after Winning TechCrush40 Top company Award and got funded $50,000 as a part of the award. If you’d like to know about start-ups that got “overnight success”, then Mint would top that list. Let’s learn in this guide everything about Mint and how it will help you make more financially smart by controlling your cash flow. That is simple to understand and automated to get you in a habit of budgeting.

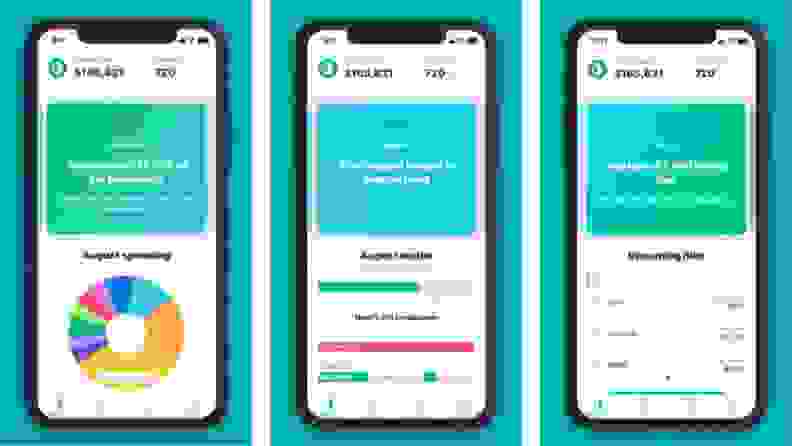

When the account gets linked, head over to budgets, and Mint will provide you a bird-eye view of what your present spending looks like in budget form. Mint is a powerful, simple, interactive free budgeting alternative in the market built to give you an overview of your finances, investments, loans, or other financial product by safely linking your bank account.

When you find the best cash flow for you, you’ll feel less cash-strapped and more likely to stick to an spending plan.Īnd you might have heard of the big secret of starting the journey to financial freedom, which is not a secret anymore: SPEND LESS THAN YOU MAKE.Ī financial budget app like MINT from Intuit makes “Spend less than you make” easy for you and regulate your cash flow for a month. If that’s the case, how can you possibly survive?īudgeting takes work, but it doesn’t have to mean self-deprivation. Not only can you not afford it, but you probably got anxious about having enough to cover your basic expenses. You can’t budget this way because you can run out of money before you could pay for “fixed expenses”. Most people do not budget and the ones who do can’t keep track may find their bank balance to be near zero.

If you’re planning to overhaul your budgeting spreadsheet and look for an automated system or realized that you need to take your money more seriously, then you have come to the right place to learn to budget. Share on Facebook Share on LinkedIn Share on WhatsApp Share on Twitter

0 kommentar(er)

0 kommentar(er)